BlackRock Inc., the world’s largest asset manager, is positioning itself at the heart of the rapidly growing artificial intelligence industry. The firm is nearing a $20 billion deal to acquire Aligned Data Centers through a newly formed investment consortium, according to people familiar with the matter.

The potential acquisition marks BlackRock’s most significant move yet into the booming AI infrastructure sector—one of the most capital-intensive and strategically vital areas of the digital economy. With demand for data processing power skyrocketing, fueled by advancements in AI and machine learning, data center operators have become essential players in the race to support next-generation technologies.

Aligned Data Centers, known for its energy-efficient facilities and rapid expansion across North America, has become a prime acquisition target as investors seek exposure to the infrastructure powering AI models. These models require massive computational resources, and demand for data center capacity is expected to multiply in the coming years.

BlackRock’s planned investment underscores the firm’s broader strategy to diversify into digital infrastructure and secure long-term returns in a market that’s attracting major institutional capital. The consortium, which includes other financial partners, is betting that ownership of physical infrastructure—such as data centers—will offer a competitive edge in a digital economy increasingly driven by AI applications, cloud computing, and big data analytics.

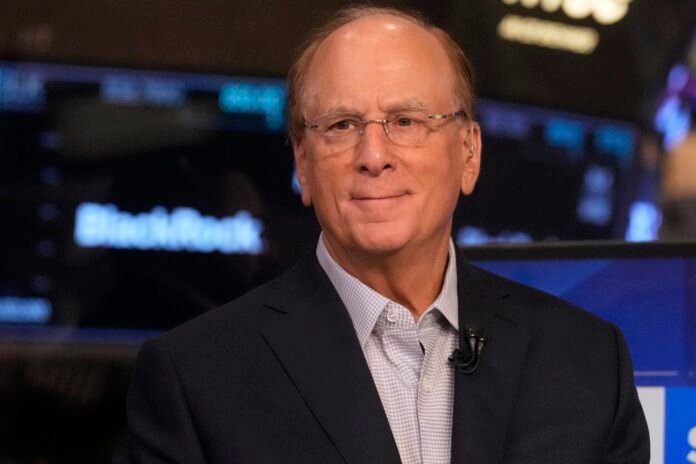

CEO Larry Fink has previously emphasized the need for long-term, resilient investment opportunities in emerging sectors. This move aligns with BlackRock’s vision of being not just a passive investor but a key stakeholder in shaping future digital infrastructure.

If finalized, the deal would rank among the largest data center acquisitions to date, signaling heightened interest in the backbone technologies supporting AI growth. It also highlights how traditional financial powerhouses like BlackRock are adapting to the technological shifts reshaping global markets.

The agreement is not yet finalized, and terms could still change, but the parties are reportedly in advanced negotiations. Should it proceed, the acquisition would cement BlackRock’s role as a serious player in AI’s physical infrastructure, potentially unlocking new revenue streams while reinforcing its reputation as a forward-looking asset manager.